Frequently Asked Questions

Answers to common questions regarding aged care fees and funding.How much will I pay if I move into residential aged care?

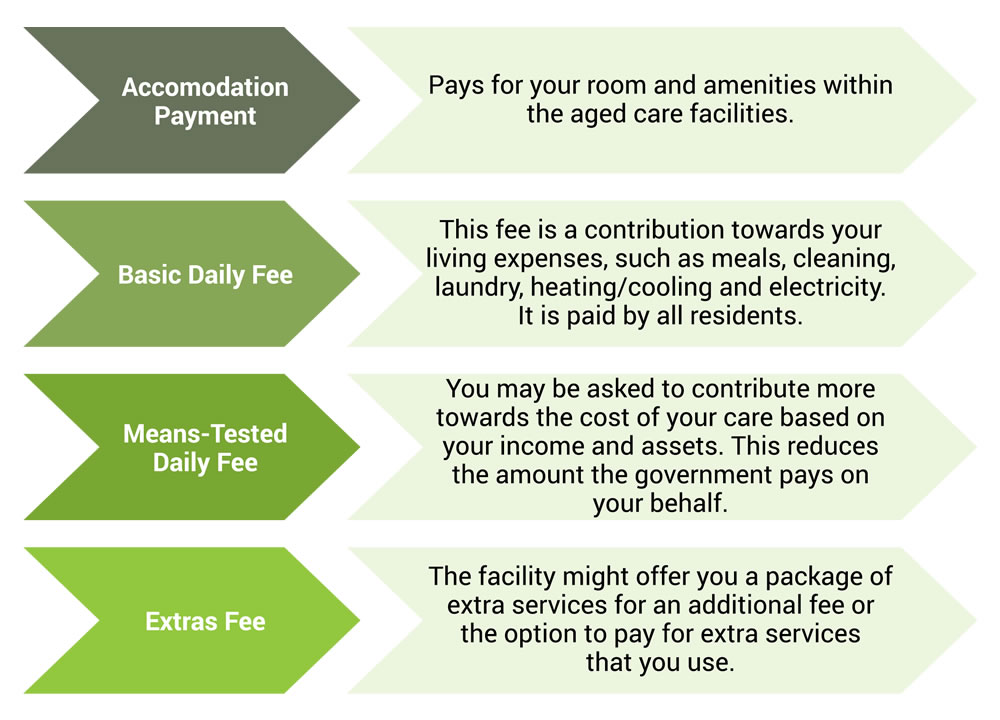

How much you will be asked to pay for your accommodation will depend on the facility and possibly even the room that you choose. You can check the maximum prices on the facility’s website or at www.myagedcare.gov.au . If you only have low levels of income and assets (and qualify as a low-means resident) the government will subsidise this cost and you may pay a lower fee than is advertised.

How much you are asked to contribute towards your cost of care will depend on your income and assets. All residents are asked to pay the basic daily fee which is set at an amount equal to 85% of the basic single rate of age pension. You will only pay more than this (as a means-tested fee) if you have income and assets over certain thresholds.

The extras fees can be mandatory or optional and negotiated with the facility as a set price.

How much you will be asked to pay for your accommodation will depend on the facility and possibly even the room that you choose. You can check the maximum prices on the facility’s website or at www.myagedcare.gov.au . If you only have low levels of income and assets (and qualify as a low-means resident) the government will subsidise this cost and you may pay a lower fee than is advertised.

How much you are asked to contribute towards your cost of care will depend on your income and assets. All residents are asked to pay the basic daily fee which is set at an amount equal to 85% of the basic single rate of age pension. You will only pay more than this (as a means-tested fee) if you have income and assets over certain thresholds.

The extras fees can be mandatory or optional and negotiated with the facility as a set price. Do I have to sell my home when I move into aged care?

When you move into care you will be asked to pay for your accommodation as either a refundable lump sum (refundable accommodation deposit – RAD) or a daily “rental” payment (daily accommodation payment – DAP).

Some residents may choose to sell their home to make these payments. Other residents may choose to keep their home so that other family members can live there or so they can earn rental income.

The choice is up to you.You are not forced to sell your home.

The choice you make may impact how much you pay for your care as well as how much age pension you are eligible to receive. Paying for advice from an Accredited Age Care Specialist may help you with your decision.

What if I can’t afford the accommodation payment?

If you have low levels of income and assets you might qualify as a low-means resident. The amount you pay towards your accommodation will be based on your income and assets.

As a general rule, you are only likely to qualify if you do not own your own home or if your spouse or other protected person will continue living in your home and you have income and assets under certain thresholds. A protected person includes carers or close family members who qualify for income support from Services Australia or Veterans’ Affairs and have already lived in your home for at least two years as a carer or five years for a close family member.

If you think you might be eligible you will need to fill in the Services Australia/Veterans’ Affairs income and assets form. Services Australia or Veterans’ Affairs will assess your income and assets to determine whether you qualify as a low-means resident.

If you do qualify you should ask your chosen facility whether a place is available for a low-means resident and check the fees that you will be asked to pay for your accommodation.

What is a refundable accommodation deposit (RAD)?

One option to pay for your accommodation is to pay the requested lump sum. This is called a refundable accommodation deposit or a RAD for short.

You can check the facility’s website to see the maximum RAD you may be asked to pay if you accept an offer of a place.

But paying the lump sum is only one choice. You can choose to pay the RAD in full or pay a daily accommodation payment (DAP) instead. The DAP is like paying interest on an outstanding loan or rent. You could also choose to pay a part RAD and part DAP. Paying for advice from a qualified financial planner may help you to make this choice.

If you choose to pay a RAD, the facility will hold this money on trust for you. The full amount is refunded when you leave or pass away.

If I pay a RAD how secure is my money?

The Federal Government guarantees the repayment of refundable accommodation deposits (RADs) which have been paid to an accredited aged care facility.

This means if the facility goes into liquidation or faces bankruptcy and cannot afford to repay your RAD the Government will pay you back the full amount owing. This makes your money very secure.

You should always ask to see the facility’s accreditation certificate to make sure it is covered by the guarantee.

If I pay a RAD, when is it refunded and how much will I receive back?

If you pay for your accommodation as a refundable accommodation deposit (RAD) you will receive this money back after you move out.

If you pass away, the RAD is repaid to your estate. The facility will generally ask to see a copy of probate for your estate. The full RAD is refunded to your executor within 14 days of seeing probate.

The full amount that you paid as a RAD is refunded unless you have asked the facility to deduct any other fees from the RAD or you have unpaid fees outstanding which the facility is able to deduct from the RAD. Your accommodation agreement will explain which outstanding fees can be deducted from the RAD.

Will I still receive an age pension after moving into care?

If you receive a payment from Services Australia or Veterans’ Affairs you need to update your records every time your circumstances change. This includes when you move into aged care.

The amount you receive after moving into care may change. It may increase or decrease depending on your circumstances and how your income and assets change.

If you are a member of a couple you will still have combined income and assets assessed but you will both start to be paid at the higher single rate of pension.

If you keep your former home you may continue to be assessed as a homeowner for a period of time with your home remaining an exempt asset for Services Australia and Veterans’ Affairs. If you entered care before 1 January 2017 and structure the arrangements carefully you can even rent your home without the income affecting your age pension or your care fees.

If you sell your home, you will become a non-homeowner but the amount you pay to the facility as a refundable accommodation deposit (RAD) is exempt for Services Australia and Veterans’ Affairs, and may help to maximise your age pension. This amount is still assessable however when calculating your means-tested daily care fee.

To ensure you maximise your Services Australia or Veterans’ Affairs entitlements it is important to seek advice from a qualified financial planner to ensure the arrangements are structured properly and to determine whether it is more effective for you to sell or keep your home.

Does the choice of aged care facility affect how much I will pay for care?

How much you pay for accommodation will depend on the facility you choose. This is much the same as buying a house where you may pay more for a house that is bigger or in a better location or with better facilities.

You are now able to compare the cost of accommodation for all facilities on the government website www.myagedcare.gov.au

The basic daily care fee is the same for all residents in all facilities because it is a flat fee set at 85% of the basic rate of single age pension (indexed every six months).

The amount you will pay for the means-tested fee depends on your income and assets, not the facility you choose to live in. Services Australia or Veterans’ Affairs will calculate your assessable income and assets and use a formula to work out the fee you will be asked to pay.

The fees for any extras you choose to use in a facility will vary and you can ask for a schedule of fees to decide if you wish to pay for them.

What happens if I use up my savings and can no longer afford to pay for care?

Most people find this is not a problem.

Before accepting an offer of a place you should check that you have enough assets to pay the refundable accommodation deposit (RAD) or ongoing income to pay the daily accommodation payment (DAP) or enough to make a combination payment (part RAD / part DAP). If you have lower means you may qualify as a low-means resident and pay lower fees. Financial advice can help you to structure your finances to ensure you can continue to meet your payments.

The amount you contribute towards your ongoing care is based on your income and assets. If your income or assets reduce, your fees may also reduce or vice versa. The government has also introduced caps on the means-tested fee to limit how much you will pay. There is a daily, annual and lifetime cap.

If circumstances beyond your control do place you in financial hardship and you can’t meet your ongoing fees you can apply to the government to have fees waived.

Where can I get help to make decisions about care?

Navigating through the financial aspects of aged care can be complicated, especially as you should take into consideration:

- How your age pension is affected?

- How to pay for your accommodation?

- What you will pay for your ongoing care?

- Whether you need to pay any tax?

- Whether you have enough cashflow to pay for your care and living expenses?

The impact on your net wealth and your estate? Paying for advice from a qualified Aged Care Specialist may help to make this easier and also reduce the stress for your family. You can also access free information to help you understand the rules from Services Australia or www.myagedcare.gov.au but an Accredited Age Care Specialist can help to put this into a plan that works for you and your family

FREE e-book

Have A Question?

If you have a question about Aged Care which isn't covered here, then chances are other people are wondering the same thing!

Send us your question and we'll include it on our FAQs.